The Packaging Industry's Sustainability Challenge: Why ERP Systems Are Essential for Success A straightforward guide to navigating sustainability regulations across folding carton, flexible...

The Reality Check: Sustainability Regulations Are Here to Stay

The Packaging Industry's Sustainability Challenge: Why ERP Systems Are Essential for Success

A straightforward guide to navigating sustainability regulations across folding carton, flexible packaging, labels, corrugated, and print industries

Global Packaging Sustainability Regulations Timeline

- EU PPWR fully in effect with immediate compliance requirements

- California EPR enrollment and data submission deadlines

- Colorado EPR enrollment and data submission deadlines

- UK EPR full implementation

- Australia National Packaging Targets deadline

- California SB 343 & SB 261 first reporting cycle

- Colorado EPR fee payments begin

- California EPR fee payments begin

- CSRD Phase 2 implementation (listed SMEs)

- Ontario Blue Box full implementation

- CSDDD expected implementation

- Washington State EPR expected implementation

- Oregon Recycling Modernization Act full implementation

- EU PPWR first major milestone (5% waste reduction)

- Paper/cardboard 90% recycling target

- Plastic packaging 65% recycling target

- California EPR 100% recyclable/compostable target

- EU PPWR second milestone (10% waste reduction)

- EU PPWR final milestone (15% waste reduction)

- France AGEC Law long-term targets

The packaging industry is experiencing the most significant regulatory transformation in decades. Whether you're manufacturing folding cartons, flexible packaging, labels, corrugated, or operating converting facilities for these markets, new sustainability regulations are fundamentally changing how you do business.

The European Union's Packaging and Packaging Waste Regulation (PPWR) came into effect in February 2025, setting aggressive targets that will influence global packaging standards. Meanwhile, Extended Producer Responsibility (EPR) programs are rapidly expanding across US states, creating new financial obligations for packaging companies. These aren't distant future concerns; they're immediate realities that require action today.

What This Means for Your Packaging Business

The new regulatory landscape creates both challenges and opportunities across all packaging sectors. Companies that adapt quickly are discovering competitive advantages, while those that delay face increasing compliance costs and reduced market access.

Folding Carton Manufacturers: Building on Natural Advantages

Folding carton companies start with inherent sustainability benefits thanks to renewable fiber-based materials and established recycling infrastructure. However, the PPWR's 90% recycling target for paper packaging means that even high-performing sectors must optimize their performance further. The regulation's design-for-recyclability requirements are pushing companies to reconsider everything from barrier coatings to adhesive selections.

The key challenge lies in maintaining functional performance while meeting new standards for recyclability. Traditional composite structures that combine paperboard with plastic barriers or specialized coatings may need redesigning to ensure compatibility with recycling systems. Companies that master this balance early will capture market share from competitors struggling with compliance.

Flexible Packaging: Navigating Complex Material Challenges

Flexible packaging faces the steepest regulatory challenges due to its multi-material structures, which provide essential barrier properties but complicate recycling efforts. The PPWR's 65% plastic recycling target presents significant challenges for traditional flexible packaging designs that combine multiple polymer layers, metal foils, and specialized coatings.

The industry is responding with innovation in mono-material designs and chemical recycling technologies. Companies are investing heavily in new barrier technologies that maintain product protection while simplifying material structures. Those who successfully develop recyclable flexible packaging solutions will gain substantial competitive advantages as brands increasingly prioritize sustainable packaging options.

Corrugated Packaging: Optimizing an Already Circular System

Corrugated packaging already achieves recycling rates exceeding 90% in most markets, making it a notable success story in the circular economy. However, new regulations focus on waste reduction rather than just recycling performance. This means corrugated companies must optimize packaging designs to minimize material usage while maintaining protective performance.

The challenge involves balancing waste reduction targets with the protective and logistical functions that corrugated packaging provides. Advanced design optimization and right-sizing initiatives are becoming essential capabilities for maintaining compliance while effectively serving customer needs.

Tag & Label: Managing Complex Interactions

The tag and label industry faces unique challenges because label sustainability affects both the label itself and the package to which it's applied. Adhesive selection can significantly impact the recyclability of labelled containers, while printing processes must comply with increasingly strict environmental regulations.

Sustainable ink technologies, wash-off adhesives, and substrate optimization are becoming critical competitive factors. Companies that master these technologies while maintaining print quality and functionality will capture growing market demand for sustainable labelling solutions.

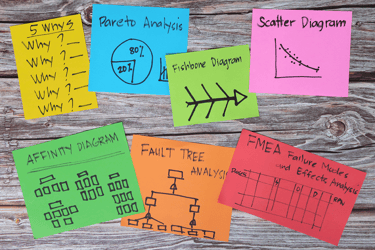

Why ERP Systems Are Essential for Packaging Sustainability

Traditional approaches to sustainability management, such as spreadsheets, manual calculations, and periodic reporting, cannot effectively handle the complexity and real-time requirements of modern packaging regulations. ERP (Enterprise Resource Planning) systems provide the integrated platform necessary for effective sustainability management across complex packaging operations.

Comprehensive Data Management

Modern packaging operations involve complex material flows, multiple suppliers, diverse customer requirements, and intricate production processes. ERP systems create a single source of truth for all sustainability-related data, eliminating the errors and inconsistencies that plague manual tracking approaches.

For packaging companies, this means real-time visibility into material sourcing, production efficiency, waste generation, and customer compliance requirements. The system automatically tracks recycled content percentages, calculates carbon footprints, and monitors compliance with multiple regulatory frameworks simultaneously.

Automated Compliance Calculations

Sustainability regulations require sophisticated calculations that consider material types, production processes, geographic locations, and end-of-life scenarios. ERP systems automate these calculations, ensuring accuracy while reducing administrative burden.

The system can automatically calculate EPR fees based on packaging placed in different markets, assess recyclability scores for complex material combinations, and generate compliance reports for multiple regulatory jurisdictions. This automation eliminates calculation errors while providing real-time visibility into compliance status.

Real-Time Performance Monitoring

Packaging operations undergo rapid changes, driven by frequent product changeovers (shorter runs), varying material specifications, and evolving customer requirements. ERP systems offer real-time monitoring capabilities, enabling the immediate identification and response to sustainability performance issues.

Energy consumption, waste generation, material efficiency, and quality metrics are continuously monitored and correlated to identify opportunities for optimization. This real-time visibility enables proactive management rather than reactive responses to sustainability challenges.

Supply Chain Transparency

Modern sustainability regulations increasingly require detailed information about supply chain practices and material sourcing. ERP systems offer end-to-end traceability capabilities that facilitate compliance with regulations such as the EU Deforestation Regulation, while also enabling the verification of sustainability claims.

The system tracks supplier certifications, material origins, and sustainability performance throughout complex multi-tier supply chains. This transparency supports regulatory compliance while enabling the identification and development of suppliers that support sustainability objectives.

The Business Case for ERP Sustainability Integration

Companies implementing ERP-integrated sustainability management report significant benefits beyond regulatory compliance. These systems enable operational optimization, cost reduction, and competitive differentiation, delivering a measurable return on investment.

Operational Efficiency Gains

Integrated sustainability management eliminates duplicate data entry, reduces manual reporting effort, and streamlines compliance processes. Companies typically achieve 50-70% reductions in the time required for sustainability reporting, while also improving data accuracy and consistency.

The system's optimization capabilities often identify opportunities for reducing material usage, improving energy efficiency, and minimizing waste, which deliver immediate cost savings. These operational benefits frequently offset system implementation costs within the first year.

Competitive Advantage Development

Companies with comprehensive sustainability data and verified performance metrics gain significant advantages in customer relationships and market positioning. The ability to demonstrate sustainability leadership through transparent reporting and continuous improvement attracts environmentally conscious customers while supporting premium pricing strategies.

Early adopters are capturing market share from competitors who cannot demonstrate equivalent sustainability performance or struggle with compliance requirements. This competitive advantage strengthens as sustainability requirements become more stringent and widespread.

Risk Mitigation and Future-Proofing

ERP systems provide early warning capabilities that identify potential compliance issues before they become problems. Automated monitoring and predictive analytics help companies stay ahead of regulatory changes while minimizing compliance risks.

The system's flexibility enables adaptation to new regulatory requirements without major system overhauls. This future-proofing capability protects technology investments while ensuring continued compliance as regulations evolve.

Getting Started: A Practical Approach

Implementing ERP sustainability management doesn't require a complete overhaul of the system. Most companies can start with targeted modules that address their most pressing compliance requirements, building toward comprehensive integration.

Assessment and Planning

Start with a comprehensive assessment of current sustainability data sources, compliance requirements, and operational challenges. Identify the highest-priority areas where ERP integration can deliver immediate value while supporting long-term sustainability objectives.

Engage stakeholders across the organization to understand requirements and build support for the implementation. Include suppliers and customers in planning discussions to ensure the system supports value chain collaboration and transparency.

Phased Implementation

Begin with core sustainability tracking and reporting capabilities before expanding to advanced optimization and analytics features. This phased approach minimizes disruption while delivering early wins that build momentum for broader implementation.

Focus initial efforts on areas with the highest compliance risk or most significant optimization potential. Success in these areas provides proof of concept while generating resources for expanded implementation.

Continuous Improvement

ERP sustainability management is not a one-time implementation but an ongoing capability development process. Regular system optimization, data quality improvement, and functionality expansion ensure continued value delivery as requirements evolve.

Establish performance metrics and regular review processes to track system effectiveness and identify opportunities for improvement. Use these insights to guide system enhancements and capability development.

Key Implementation Milestones by REGION

-

2023US: California SB 253 (Climate Corporate Data Accountability Act) signed

-

US: California SB 261 (Climate-Related Financial Risk Act) signed

-

2024US: California EPR enrollment deadline (July 1)

-

2025US: California EPR enrollment deadline (July 1)

-

US: US: Data submission deadlines (Aug 31)

-

US: US: Data submission deadlines (Aug 31)

-

2026US: US: California EPR fee payments begin

-

US: US: Colorado EPR fee payments begin

-

US: US: California SB 253 first reporting cycle

-

US: US: California SB 261 first reporting cycle

-

2027US: US: Oregon Recycling Modernization Act full implementation

-

US: US: Washington State EPR expected implementation

-

US: US: New York Packaging Act expected

-

2028US: US: Additional state EPR programs expected

-

2029US: US: Federal EPR framework discussions

-

2030US: US: State program optimization and expansion

-

2032US: US: California 100% recyclable or compostable packaging target

-

2022Canada: Provincial EPR program updates

-

2023Canada: Federal Plastics Registry development

-

2024Canada: Federal Plastics Registry preparation

-

2025Canada: Federal Plastics Registry mandatory reporting begins

-

2026Canada: Ontario Blue Box Regulation full implementation

-

2027Canada: Enhanced federal measures development

-

2028Canada: Federal-provincial harmonization

-

2030Canada: Enhanced federal packaging regulations expected

-

2023EU: EUDR (EU Deforestation Regulation) enters into force

-

EU: CSRD (Corporate Sustainability Reporting Directive) adopted

-

2024EU: EUDR full compliance deadline (Dec 30)

-

2025EU: PPWR (Packaging and Packaging Waste Regulation) enters into force

-

EU: CSRD Phase 1 - Large companies begin reporting

-

2026EU: CSRD Phase 2 - Listed SMEs begin reporting

-

2027EU: CSDDD (Corporate Sustainability Due

-

Diligence Directive) expected implementation

-

2028EU: CSRD Phase 3 - Non-EU companies

-

EU: CSDDD full implementation

-

2030EU: PPWR 5% waste reduction target

-

EU: Paper/cardboard 90% recycling target

-

EU: Plastic packaging 65% recycling target

-

EU: Metal packaging 85% recycling target

-

2035EU: PPWR 10% waste reduction target

-

EU: Enhanced recycling targets

-

2040EU: : PPWR 15% waste reduction target

-

EU: Full circular economy implementation

-

France: AGEC Law long-term targets

-

2022UK: Plastic Packaging Tax

-

(£200/tonne for <30% recycled content)

-

2023UK: EPR for Packaging development and consultation

-

2024UK: EPR system preparation

-

2025UK: EPR for Packaging full implementation

-

2026UK: EPR system optimization begins

-

2027UK: Additional circular economy measures expected

-

2028UK: System expansion and optimization

-

2030UK: Enhanced recycling targets expected

-

2020China: Plastic Pollution Control Policy begins

-

2022Australia: Plastic Waste Export Ban

-

Japan: Plastic Resource Circulation Act

-

2023South Korea: Enhanced EPR system implementation

-

2025Australia: National Packaging Targets deadline

-

Japan: Enhanced recycling requirements

-

China: Plastic restrictions fully implemented

-

2026Asia-Pacific: 60% plastic packaging recycling target

-

2030Japan: Enhanced federal measures development

-

South Korea: 70% plastic packaging recycling targe

The Future of Packaging Sustainability

Sustainability regulations will continue to evolve and intensify across all packaging sectors. Companies that establish comprehensive ERP-integrated sustainability management capabilities today will be well-positioned to lead their industries' continued transformation toward sustainable practices.

The packaging companies that thrive in this new environment will be those that view sustainability not as a compliance burden but as a catalyst for innovation, efficiency, and competitive advantage. ERP systems provide the technological foundation necessary to transform regulatory challenges into business opportunities.

The choice is clear: adapt proactively with integrated sustainability management or struggle reactively with compliance challenges. The companies that choose to lead will shape the future of sustainable packaging while capturing the competitive advantages that leadership provides.

Ready to transform your packaging sustainability capabilities? Contact ePS to discover how our industry-specific ERP can help your company navigate complex regulations while driving operational excellence and achieving a competitive advantage. Our proven platform supports packaging companies across all sectors to attain sustainability leadership while optimizing business performance.